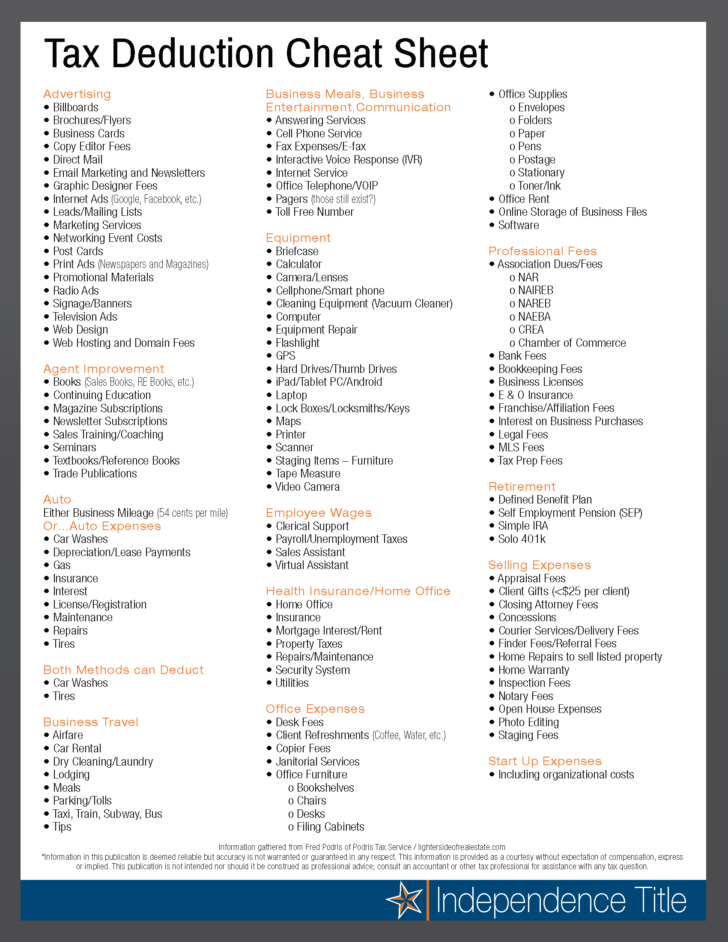

However, unreimbursed moving expenses were not subject to the 2% floor and are deductible in arriving at adjusted gross income. Note that the deductible amount for meals and entertainment expenses was limited to 50% of actual costs.īusiness expenses were deductible only to the extent that, when added to other miscellaneous itemised deductions, they exceed 2% of adjusted gross income. Travel and entertainment expenses, subject to certain limitations.Ordinary and necessary business expenses, including those for business (or employment) connected moving.

Travel or personal living expenses (to the extent not reimbursed) while 'away from home' ( see Employment income in the Income determination section for more information).Business expensesįor years before 2018, citizens, residents, and non-resident aliens generally were able to deduct expenses incurred for the following: If an individual is both blind and age 65 or over, the standard deduction may be increased twice. Individuals, including resident aliens, who are blind or age 65 or over are entitled to a higher standard deduction. For 2021, such an individual who is married may increase the standard deduction by USD 1,350 and for 2022 USD 1,400 if such an individual is single, the additional standard deduction is USD 1,700 and USD 1,750, respectively. Non-resident aliens may not claim a standard deduction. These amounts are adjusted annually for inflation. For 2021 the standard deduction is USD 25,100 for married couples filing a joint return, USD 12,550 for individuals, and USD 18,800 for heads of household. The basic standard deduction for 2022 is USD 25,900 for married couples filing a joint return, USD 12,950 for individuals, and USD 19,400 for heads of household. Instead of itemising deductions, citizens and resident aliens may claim a standard deduction.

Disallowed excess investment interest expense may be claimed as a deduction in subsequent years, to the extent of net investment income. investment income net of investment expenses other than interest). However, interest paid on investment debt is deductible, but only to the extent that there is net investment income (i.e. No deduction is allowed for personal interest. Non-resident aliens may deduct, subject to limitations, casualty and theft losses incurred in the United States, contributions to US charitable organisations, and state and local income taxes. Alimony (no longer deductible for divorces occurring after 31 December 2018).Medical expenses, certain casualty, disaster, and theft losses, and charitable contributions, subject to limitations.State and local income or sales taxes and property taxes up to an aggregate of USD 10,000.Personal deductionsĬitizens and resident aliens can deduct the following common items: In order to itemise such expenses, they must have been greater than 2% of adjusted gross income.

Common deductions included travel expenses and transportation costs (other than commuting to and from work), business entertainment and gifts, computers and cell phones if required for the taxpayer's job and for the convenience of the employer, uniforms, and home office expenses, among others. For years before 2018, employees may have been able to deduct certain 'ordinary and necessary' unreimbursed work-related expenses as an itemised deduction.

0 kommentar(er)

0 kommentar(er)